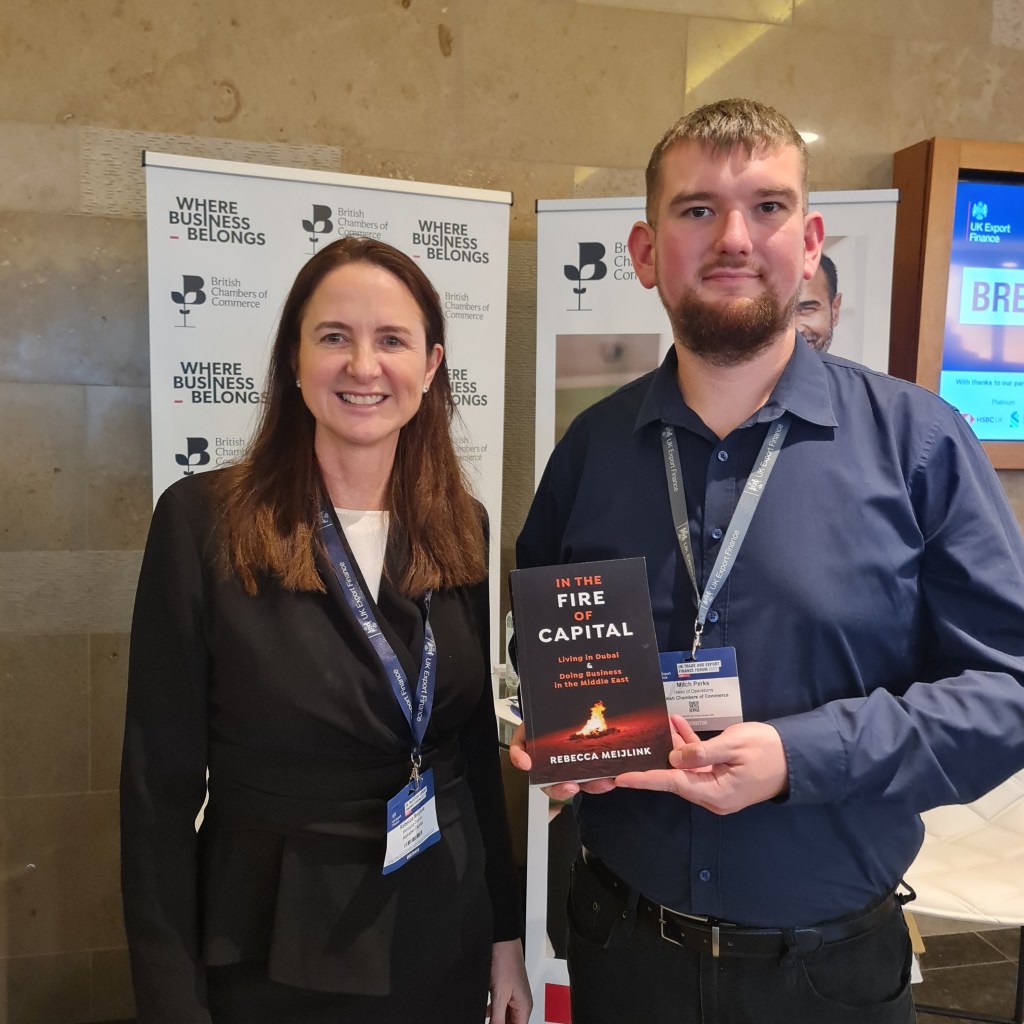

I was grateful for the invitation to the UK Trade and Export Finance Forum 2023 in London. I met many people and had extensive chats with the team at UK Export Finance (UKEF). It was a great opportunity to learn more about the financing that can be provided, and I had the opportunity to introduce my book ‘In the Fire of Capital, Living in Dubai & Doing Business in the Middle East’, making an impact by accelerating the learning curve for companies looking to do business in the Middle East. The event was buzzing! I spoke to UKEF’s CEO Tim Reid, and with the team in charge of renewable and infrastructure projects. They told me that they are active in the Middle East. I am happy to put you in touch if you think UK Export Finance (UKEF) can be helpful. See Small and medium sized businesses – UK Export Finance

UK Export Finance can play a valuable role in helping UK companies raise capital and grow their export business. By providing a range of financial products and services, as well as export advice and support, UKEF can help to remove some of the barriers to exporting and make it easier for UK companies to succeed in the global marketplace.

UKEF can provide direct loans to UK exporters to support their export activities. This can be particularly helpful for companies that are struggling to access financing from traditional lenders due to the perceived risks associated with exporting. UKEF can issue loan guarantees to banks that are lending to UK exporters. This can help to reduce the risk for the banks and make it more likely that they will be willing to lend to exporters. UKEF can provide insurance to UK exporters against the risk of their overseas buyers not paying them for the goods or services they have exported. This can help to protect exporters from financial losses and give them the confidence to export to new markets. UKEF can work with private sector banks and insurers to develop new products and services specifically designed to meet the needs of UK exporters. This can help to increase the availability of export finance for UK companies. UKEF can provide working capital loans to UK exporters to help them cover the costs of fulfilling export contracts. This can be particularly helpful for small and medium-sized enterprises (SMEs) that may not have the financial resources to meet the upfront costs of exporting. UKEF can advise UK companies on all aspects of exporting, from identifying overseas markets to managing export risks. UKEF can provide UK companies with information on specific overseas markets, including market trends, regulations, and potential customers. UKEF can help UK companies to connect with potential overseas buyers and partners.

The London Growth Hub, is a good resource: https://www.growlondonlocal.london/.

Department for Business & Trade, which has a lot of useful support services to assist in accessing new markets: https://www.great.gov.uk/advice/.

Link to finance options: https://www.findingfinance.org.uk/.